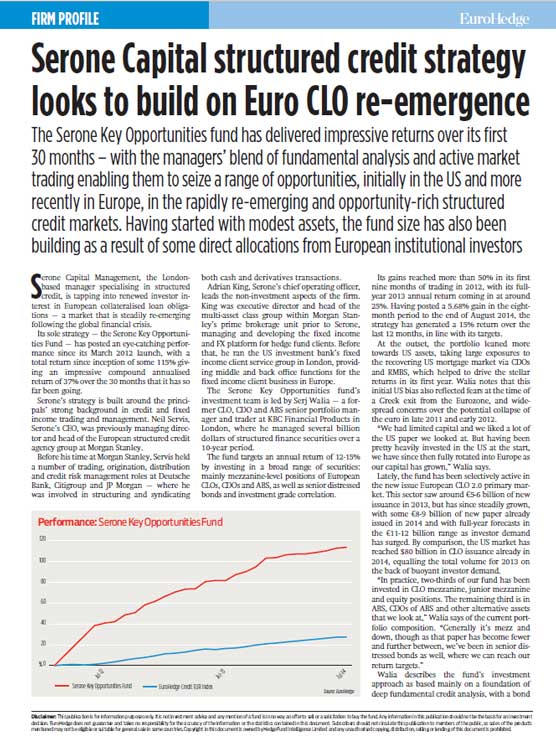

Serone Capital Structured Credit Strategy Looks to Build on Euro CLO Re-emergence

The Serone Key Opportunities fund has delivered impressive returns over its first 30 months – with the managers’ blend of fundamental analysis and active market trading enabling them to seize a range of opportunities, initially in the US and more recently in Europe, in the rapidly re-emerging and opportunity-rich structured credit markets. Having started with modest assets, the fund size has also been building as a result of some direct allocations from European institutional investors

Serone Capital Management, the London-based manager specialising in structured credit, is tapping into renewed investor interest in European collateralised loan obligations – a market that is steadily re-emerging following the global financial crisis.

Serone’s strategy is built around the principals’ strong background in credit and fixed income trading and management. Neil Servis, Serone’s CEO, was previously managing director and head of the European structured credit agency group at Morgan Stanley.

Before his time at Morgan Stanley, Servis held a number of trading, origination, distribution and credit risk management roles at Deutsche Bank, Citigroup and JP Morgan – where he was involved in structuring and syndicating both cash and derivatives transactions.

Adrian King, Serone’s chief operating officer, leads the non-investment aspects of the firm. King was executive director and head of the multi-asset class group within Morgan Stanley’s prime brokerage unit prior to Serone, managing and developing the fixed income and FX platform for hedge fund clients. Before that, he ran the US investment bank’s fixed income client service group in London, providing middle and back office functions for the fixed income client business in Europe.

The Serone Key Opportunities fund’s investment team is led by Serj Walia – a former CLO, CDO and ABS senior portfolio manager and trader at KBC Financial Products in London, where he managed several billion dollars of structured finance securities over a 10-year period.

The fund targets an annual return of 12-15% by investing in a broad range of securities: mainly mezzanine-level positions of European CLOs, CDOs and ABS, as well as senior distressed bonds and investment grade correlation.

At the outset, the portfolio leaned more towards US assets, taking large exposures to the recovering US mortgage market via CDOs and RMBS, which helped to drive the stellar returns in its first year. Walia notes that this initial US bias also reflected fears at the time of a Greek exit from the Eurozone, and widespread concerns over the potential collapse of the euro in late 2011 and early 2012.

“We had limited capital and we liked a lot of the US paper we looked at. But having been pretty heavily invested in the US at the start, we have since then fully rotated into Europe as our capital has grown,” Walia says.

Lately, the fund has been selectively active in the new issue European CLO 2.0 primary market. This sector saw around €5-6 billion of new issuance in 2013, but has since steadily grown, with some €8-9 billion of new paper already issued in 2014 and with full-year forecasts in the €11-12 billion range as investor demand has surged. By comparison, the US market has reached $80 billion in CLO issuance already in 2014, equalling the total volume for 2013 on the back of buoyant investor demand.

“In practice, two-thirds of our fund has been invested in CLO mezzanine, junior mezzanine and equity positions. The remaining third is in ABS, CDOs of ABS and other alternative assets that we look at,” Walia says of the current portfolio composition. “Generally it’s mezz and down, though as that paper has become fewer and further between, we’ve been in senior distressed bonds as well, where we can reach our return targets.”

Walia describes the fund’s investment approach as based mainly on a foundation of deep fundamental credit analysis, with a bond trading strategy overlay.

“You have some hedge funds out there who are very good at the trading side, but do they do the deep credit work on the portfolios and deals they buy? On the other side, you have the buy-and-hold guys in Europe who do perform the deep credit work, but they don’t mark-tomarket trade it – they just hold. We combine both,” Walia explains.

In the two and a half years since launch, there have been no negative months during the life of the fund except for July 2013, when it was down by just three basis points. Returns have come mainly from three particular areas: buying pre-crisis bonds, which trade below par; the coupon interest from new issue deals, which trade closer to par but with a higher bond coupon on them; and, finally, the general secondary market trading of bonds.

“We’re not a buy-and-hold manager,” Servis says of the firm’s approach to trading. “If we think the market is going to go down over the next three months, we would look to trade out. Now that may sound like an obvious thing to say, but there are investors out there who would say, ‘In the long term, it’s money-good – I’ll hold it’. That’s not our approach. Some months we may have a pretty high turnover in the fund – maybe 25% – then other months it’s quieter.”

Having initially launched with modest assets comprising Serone’s own capital, along with money raised from family offices, alternative fund-of-fund investors, and a small group of friends and family, the Key Opportunities Fund has garnered growing interest from larger institutional clients.

Allocations from two continental European pension funds and one European insurance company (together comprising about 40% of Serone’s total capital) have brought the fund’s total size to $150 million – with assets under management doubling this year.

And with an annual return target of 12-15%, Servis sees structured credit as a product that is a suitable and stable fit for these larger institutional players, who target that 8-12% return bracket over the long term.

“As we’ve matured, and as the fund has grown and the track record has got longer, the larger institutional guys have become much more interested in what we’re doing, particularly as the structured credit market has healed,” Servis says of the firm’s evolving client base.

“A lot of them perhaps used to go via fundof-funds – now they are coming to us directly. They want to get closer to where their capital is. It may take them longer in terms of due diligence, but it also means that when we do have down months, which will happen at some point, investors are also more patient to keep their money in because they’ve spent that time on due diligence and they understand the dynamics.”

Elaborating on the firm’s approach to investors, Servis says the fund is heavily focused on matching assets with liabilities, and adds that ensuring that all assets in the portfolio are funded correctly helps to keep investors protected. It is for that reason that the firm has opted not to launch a UCITS version of its fund.

“Our terms are a one-year hard lock, and quarterly-level investor gates, so as you redeem you come out 25% per quarter. The market may be very liquid right now, but to manage this product over time, those are the kind of liquidity terms we need to be able to manage the portfolio for investors’ interests,” says Servis.

“I don’t want to badmouth UCITS, but people are out there offering much better liquidity terms than we offer, and I’m not sure that’s the correct way to manage the assets,” he explains. “This is not a week-to-week product. It is semiliquid; it sits between private equity and investment grade liquid credit.

“We are set up so that if people want to redeem from the fund, then we’ve got time to organise their exit, and that’s in all investors’ interests. If you invest in this product you need to take a medium-term view – a two to threeyear view on the asset class, and an 18-month view on the investment.”

Since its inception, the fund has had an unlevered portfolio, though it can and may use leverage periodically in individual bonds, Walia says. “We have hedged and stress-tested the portfolio whenever we’ve been nervous in the markets,” he notes, pointing to a range of events over the past 12 months, including the sustained taper speculation in 2013, the appointment of Janet Yellen as chair of the US Federal Reserve in February, and the broader recent macro events occurring in Ukraine and the Middle East.

Looking ahead, King says that Serone, which was granted AIFMD authorisation by the Financial Conduct Authority in early June, is now looking to increase its assets under management towards the end of the year. He notes that with the infrastructure and people already in place (Serone has a total of 10 staff) the firm could run double its current AUM of $150 million.

The team has also been growing. The firm recently hired Cecilia Yu, an ex-Citigroup ABS trader, and Neill Rafter, a former BlackRock data and modelling specialist. Yu joined Serone as a trader and investment analyst, focusing on trading strategy and asset evaluation in European ABS/MBS and CDOs of ABS. Previously she specialised in UK and European RMBS, ABS and SME securitisation within Citigroup’s global securitised products group in London.

Meanwhile, Rafter is an investment analyst at Serone focusing on quantitative/data analytics, in particular the evaluation and monitoring of structured credit investment opportunities.

“We would look to add one or two junior investment staff as the AUM grows, though we don’t really need to add any more on the operational side,” King says.

Servis adds: “The team here is very Europeanfocused, both terms of language and experience, and with the high number of quality structured credit investors in the US, we are not trying to compete with them.

“We are pretty high-conviction European corporate risk; we like the lower for longer interest rate backdrop, which we think leads to low default rates, and we like expressing that view through the CLO market,” Servis explains.

“Essentially we are investing in leveraged corporate credit risk through CLOs, diversified portfolios where the underlying assets are predominantly European leveraged loans – senior secured loans, floating rate products. It’s a very nice way to get access to the corporate credit market.

“We do have the ability to invest in loans, but we don’t. We would rather buy CLOs than portfolios of loans directly, because you can trade the CLO bonds; your bond gives you exposure to a portfolio of corporate credit risk, and you have subordination in the mezz space. It’s one of the few securitised products that has performed well through the crisis.”

Please note references to Fund performance have been removed

Published

30 September 2014