CLO Spotlight: Soaking up Potential Stress

An article from Serone Capital Management in September’s edition of PDI commented that European Structured credit was an attractive way for institutional investors to generate yield. Investment analyst Stuart Chapman now analyses the robustness of mezzanine CLO securities to very high and sustained default rates and concludes that the current cohort of ‘CLO 2.0’ securities are up to the challenge.

Collateralised loan obligation (CLO) liabilities provide investors access to diversified pools of secured corporate lending in the form of tradable public debt securities. Senior and mezzanine debt tranches of CLOs offer predictable floating-rate income at attractive credit spread premia to other comparably-rated credit asset classes. For instance, Morgan Stanley estimates the average historical credit spread for ‘A’ rated CLO securities is 3.3 times that of ‘A’ rated corporate bonds; this ratio is currently higher given discount margins are ca. 350 basis points and 90 basis points over LIBOR, respectively. This relative value is generating interest amongst an increasing range of asset allocators for good reason – higher yielding, low duration assets are a rare breed in today’s low-rate environment.

A common misconception, which has previously kept some investors on the sidelines, is that wider spreads are compensation for poor fundamental performance. In contrast to more complex corners of the US mortgage securitisation market that performed poorly through the recent credit crisis, global CLO liabilities have consistently performed robustly through credit cycles. S&P data shows that over the last twenty years only eight of 5,185 US CLO tranches with original investment grade ratings have defaulted – a default rate of 0.15 percent. Similar data for investment grade corporates puts their five year cumulative default rate at 1.07 percent. Notably, no CLO tranches originally rated ‘AAA’ or ‘AA’ have experienced a loss. Data available is US centric, but from our practical experience European CLOs have performed similarly to their US counterparts.

Born to be strong

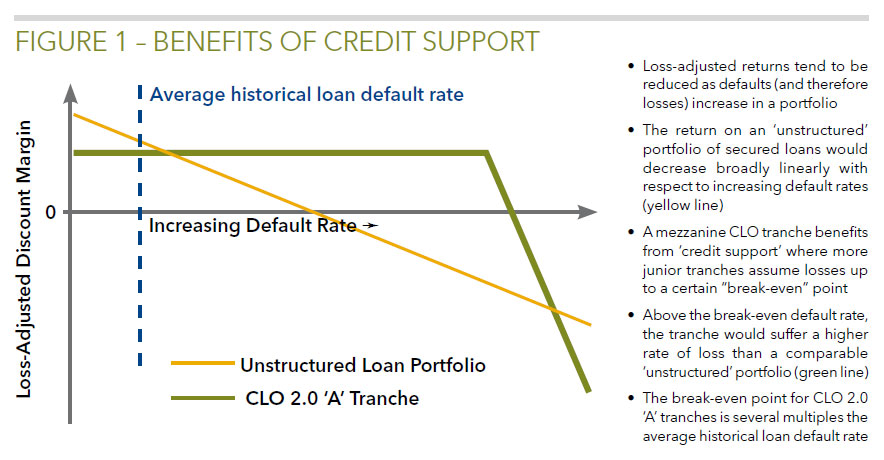

This resilience can be attributed to a variety of reasons. Firstly, CLOs principally invest in senior secured floating rate loans that are extended to established companies and benefit from first priority security over the assets of the borrower. Secondly, the CLO collateral portfolio is independently selected and actively managed by an experienced credit manager, whose compensation is geared towards the performance of the CLO. Performance depends heavily on minimising future credit losses. Thirdly, documented concentration limits over individual borrowers, sectors and jurisdictions promote broad-based diversity within the portfolio. Fourthly, CLOs benefit from term financing. This mitigates the mismatch between asset and liability funding. This financial structure ensures that the funding for the CLO remains in place when the credit markets experience bouts of stress. Lastly, the structure of the CLO dictates that the lowest rated tranches experience the effects of losses within the collateral pool first. As Figure 1 illustrates, this credit support protects the more senior tranches up to a point. Further structural protections for senior tranches are layered in by way of a series of financial ratio tests that divert cash flow away from lower ranking tranches in favour of their senior counterparts should credit performance of the collateral deteriorate. This structural and financial support is a key benefit of investing in corporate credit via senior and mezzanine CLO securities.

Notwithstanding these inherent strengths, the CLO market has evolved from its precrisis format (dubbed “CLO 1.0”) to provide investors in CLO debt tranches issued after the crisis (“CLO 2.0”) with higher structural support, added legal protections and tighter constraints over the collateral portfolio composition. Coupled with 2.0 structures becoming more uniform across the market, it can be argued that now more than ever CLO debt looks appealing to investors.

Breaking mezz…

In order to analyse CLO liabilities in depth, an investor needs to look at the investment from many different perspectives, including potential credit defaults, recovery expectations and interest rate and currency risk. One simple approach to demonstrate the fundamental strength of a CLO tranche is to simulate how much collateral losses would have to rise in order to cause the first euro or dollar of loss to their investment. An investor can reasonably expect ultimate payment of interest and principal in full on their investment under any scenario less severe than this “break-even” scenario. This analysis effectively condenses the variety of deal-specific features into a single measure to aid comparison.

We focus our analysis on a sample of 37 senior mezzanine tranches originally rated ‘A’ that were issued across 30 European 2.0 CLOs since 2013. These ’A’ rated tranches generally represent about six percent of the total capital structure and are supported by over 20 percent of the capital structure which will absorb losses before them. The collateral portfolios underpinning these securities have on average approximately 90 individual borrowers each, of which the majority of exposure is to core European countries – exposure to periphery countries is generally less than 10 percent. On average, the largest borrower in each deal represents around 2.5 percent of the total collateral balance.

We simulate collateral losses as an interplay between defaults and recoveriesu upon default. The average recovery rate on defaulted first lien loans to European corporates is measured by S&P at 75.5 percent over the last ten years (the median recovery rate is higher at 90 percent). Our variable in this break-even analysis is the amount of defaults. The Annual Default Rate (ADR) of a portfolio is the percentage of defaults the portfolio experiences in each year of the portfolio’s life. S&P measures the ADR for the universe of speculative grade debt between 2003-2013 at 4.6 percent, which of course includes the difficult credit environment following the global financial crisis.

CLO loan collateral generally repays within four to five years, which equates to a prepayment rate of 20 percent to 25 percent. However, prepayment rates generally reduce in high default scenarios as refinancing activity diminishes in periods of financial stress. Lower prepayments increase the time frame when losses can accumulate so we have used a conservative assumption of a 10 percent prepayment rate to further stress the scenario.

Our analysis shows our bond sample has a median break-even ADR of 26.4 percent with variation across bonds ranging between 22.9 percent and 35.6 percent. Our cohort can therefore withstand a sustained barrage equivalent to nearly six times the loan market ADR in every year of its life, coupled with lower prepayment rates, before taking any losses. Reframing this comparison, one must subject the CLO portfolios to nearly twice the peak market ADR (observed in third quarter of 2009 at ca. 14 percent) in each of the eight or nine years of the bond’s simulated life in order to break its cash flow stream.

At these levels, around a third of the portfolio collateral has been completely writtenoff, which, when considered against the structural support of 20 percent, highlights the additional benefit to senior and mezzanine tranches from the cash flow diversion tests previously mentioned.

Even if we instead impose a more draconian assumption on loss severities by simulating a recovery rate of only 50 percent on defaulted loans, the sample still performs well. The median break-even ADR is 13.3 percent on this basis. In aggregate this represents roughly five times the cumulative loss experienced under average default and loss severity rates observed in the market.

It is important to note that we have not attributed any value to CLO managers’ actions to minimise losses or to capture upside from improving credits. Research shows that CLO managers achieve markedly lower loss experience than the wider loan market, with certain CLO managers outperforming others.

A warning from other structured finance asset classes…

As we have mentioned before CLO’s benefit from term financing thereby avoiding so called ‘mark-to-market’ triggers. Under extreme stress scenarios, term financing may break down if the CLO hits Event of Default (EOD) triggers. If EOD triggers are hit, the CLO may enter a forced liquidation, which can lead to collateral losses. It is important therefore to understand fully the legal framework of the CLO alongside scenario analysis.

Conclusion

In the current low yield world, CLO debti liabilities can offer considerable value to long-term investors seeking highly robust, credit-risk remote debt investments with both low interest rate duration risk and enhanced credit spread. As we have shown, mezzanine CLO liabilities can withstand several times the historical credit loss experience and still return full coupon and principal to the investor. This risk profile is one reason why investors are increasingly drawn to consider CLO securities as a candidate for their core income allocations. CLO issuance has kept pace with investor demand with over USD 133 billion securities issued globally in this year alone. The European CLO market has seen its own renaissance in “2.0” format, embedding lessons learnt through the crisis. With tighter constraints on bank-led financing, the institutional loan market will likely grow in importance as a source of term financing to the corporate sector in Europe. This transition towards more capital marketsdriven lending (as seen in the US) will further promote acceptance of accessing European corporate credit via CLOs.

Published

3 December 2014