AltCredit. CLOs: Finding Income and Stability in Volatile Markets

Serone Capital Management’s CEO Neil Servis and IR Associate Hassan Jeraj outline how structured credit can help portfolios to generate stable returns in volatile and uncertain times

Credit investors are finding that, in order to generate sufficient income, they must either move down the ratings spectrum or lock up capital for longer. Strategies around high yield bonds or direct lending and private debt are popular examples of this phenomenon. Structured credit provides an attractive and often overlooked alternative.

The term ‘structured credit’ may elicit painful memories of the financial crisis of 2008-2009, with many investors refusing to consider any investment with an acronym that begins with a ‘C’. The stigma surrounding this asset class after it was blamed for causing the credit crunch lingers on almost a decade later.

Investors always face the dilemma of risk and return, but after one of the worst starts to a trading year on record, there will be a growing focus on de-risking portfolios and investing in safe haven assets. At the moment, government bonds and investment grade credits yield modest returns, gold remains volatile, and Sweden and Switzerland will actually take a haircut for putting your money in the bank.

Meanwhile, pension funds and insurers still need to satisfy liabilities while other players will want to maintain market exposures that are less likely to incur principal losses but provide income or acceptable return potential (given current risks).

When did you last see one of those?

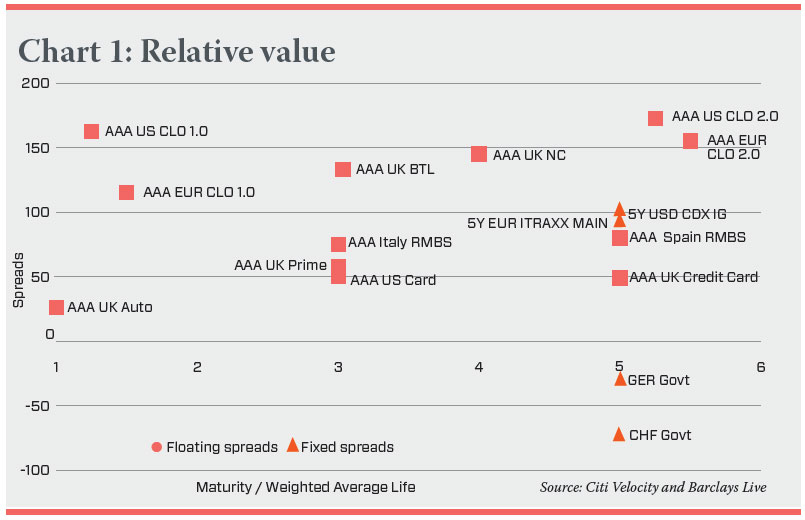

The cases for structured credit and in particular CLO exposure are manifold. The most obvious argument is relative value.

Looking at the graph below, at first glance, one may conclude that CLOs show some relative value (as of 1 February). There were long periods during 2014-2015 when AAA CLOs traded at yields that were multiples higher than corporate credit for example. This extra yield persists across the CLO capital stack. The uninitiated might question if the pickup is significant enough to compel an allocation to the space?

There is more to it than meets the eye. It is important to distinguish between assets that are floating and fixed interest rate for two reasons: the Federal Reserve’s ending of its zero rate interest policy and the continued European Central Bank’s quantitative easing program.

In a rising rate environment such as the one expected in the US, holding fixed coupon assets with a long weighted average life, and thus high duration, leaves the investor with significant interest rate risk. Negative convexity in such a situation could mean investors would face losses selling out of assets, encouraging a longer holding period. CLO liabilities are floating rate, secured on floating rate assets which extinguishes this risk.

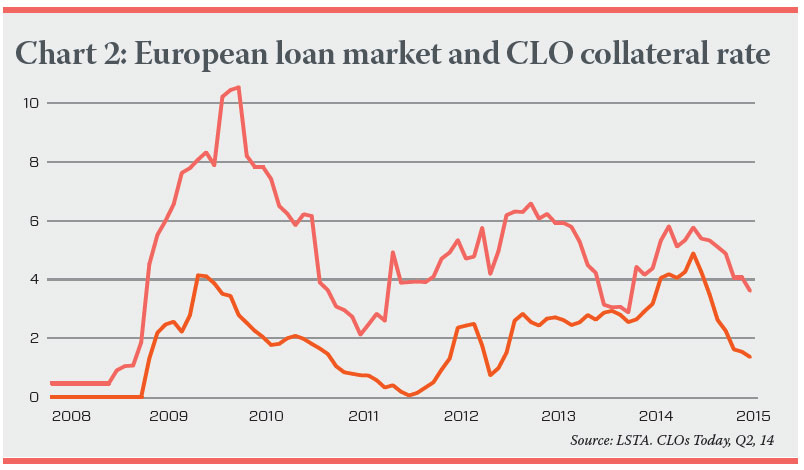

Interest rate rises, however, broadly lead to increased credit default risk. There is a potential in Europe for further Central Bank easing. While CLOs are not included in the ECBs asset purchasing programme, its actions provide asset support, and therefore a technical and fundamental bid for the asset class. Lower interest rates keep debt affordability at good levels, reducing expected default rates, while the bid for assets that CLO liabilities are secured on, gives a further tailwind. These market conditions are highly conducive to strong performance of CLO liabilities.

Investment managers, no matter how skilled, are finding it difficult to generate alpha as informational advantages disappear, thus increasing market efficiency. In an age where communication technology and data is so abundant, one would imagine that this must apply to nearly all markets.

The information regarding structured credit securities and their complexities remains a barrier to entry. It is essential to analyse each security in great detail. Confirming that provisions contained in the legal documents are being interpreted and modelled appropriately by all players, this can be particularly challenging. Tranches may contain nuances where legal documents contradict, or do not fully reflect the market perception of the structural model.

An investor must build a wide spectrum of potential scenarios accurately, including default projections in order to correctly price the risk of the security they are investing in.

Is it different this time?

In securitisations, cash flows and values are ultimately derived from underlying collateral. CLOs have shown a high level of resilience over the credit cycle. The structure, motivation and logic behind such securities is designed to allow investors to access private loans in a format containing high diversity and participation in different risk and return profiles depending on appetite. It should also be noted that CLO liabilities are securities that can be traded via clearing systems such as Euroclear.

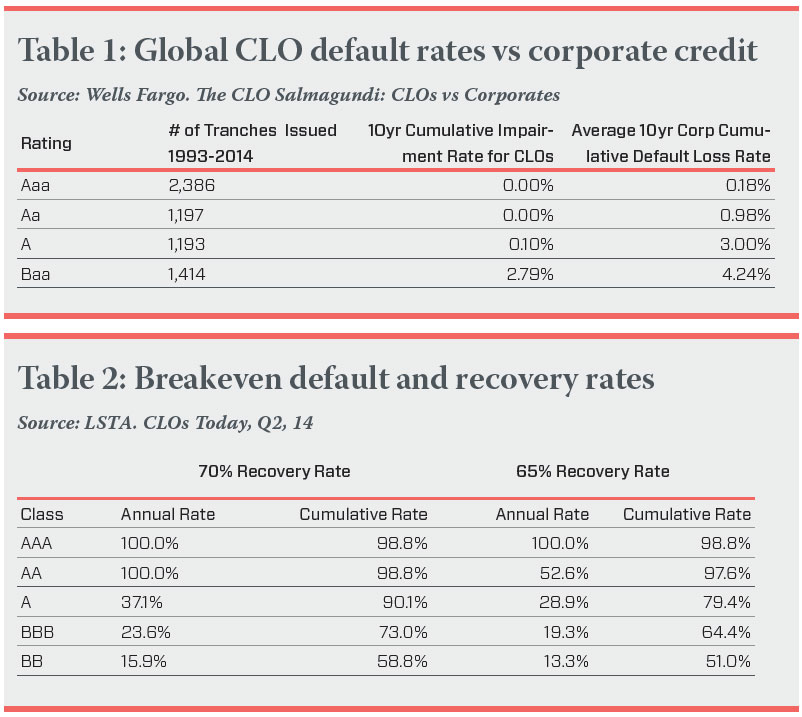

Readers might question the statistics below. How is it that this asset class led to the sorts of losses that posed a systemic risk to the financial system? And, how to put faith into such securities once again? It is important to differentiate CLOs from other, riskier securitised products.

In the case of securitised subprime mortgages holders of senior, AAA-rated tranches suffered principal losses during the financial crisis. The reason was that the underlying collateral consisted of pools of mortgages highly speculative in nature, with underlying borrowers including NINJAs (no proof of income, no proof of job and assets). Problems were further compounded by high correlations and increased rates that borrowers would pay at the end of a teaser period. Sub-prime borrowers secured loans on sub-prime properties in sub-prime locations, leading to higher delinquencies within the collateral pools.

With such high delinquency rates in the collateral pool, downgrades inevitably occurred, impacting ratings and causing credit losses.

Apples and oranges

CLOs typically contain first lien, floating rate, senior secured loans to a diverse range of companies which often have raised debt during a leveraged buyout or strategic acquisition. Such corporates include household names, for example First Data and Ziggo BV, which undergo an underwriting and syndication process arranged by banks. The manager of the CLO has a key role in selecting, and managing the underlying loan portfolio.

Default rates experienced within CLO collateral pools is favourable when compared with the wider market. Leveraged loans are a good source of underlying collateral, particularly given the alignment of private equity firms with its lenders is an important consideration.

Broadly risk retention rules state that CLO managers should either hold 5% across the capital stack or typically around 50% of the riskiest tranche further promotes mutual interests.

Execution and liquidity management

This asset class is complex, requiring manpower, technology and expertise. Combined with the added element of sourcing and trading in an OTC market where scrutinising a bond can be time intensive, relationships, trust and reputation are also important elements.

It is necessary to have a rigorous securities screening process, which begins with a top down macroeconomic view and ends with a trading view, while each individual security traded also undergoes a consistent evaluation process from collateral quality to manager evaluation.

As liquidity risk becomes an increasing concern in all markets, an experienced operator is required to optimise execution, and construct a portfolio that generates high levels of income, with a duration and liquidity profile that can be actively managed.

Published

24 February 2016