AltCredit. Should the ECB Extend its QE to Include SME CLO Programmes

Hassan Jeraj and Neil Servis from Serone Capital Management examine the landscape for CLOs following the ECB’s recent QE measures

The ECB meeting on 8 September demonstrated the dilemma it faces. Inflation at 2%, the key metric that the Bank is trying to promote still seems remote, and the outlook for increased growth and employment remains challenging as a result. Combined with potential longer term effects of Brexit, one could argue that deflation is still a possibility, which was an initial key motivator for QE in the first place. The pause in the announcement of further measures will become a much larger talking point in the run-up to December, with the potential that the program tapers off in March 2017, and ends without achieving its aims.

Many market participants and commentators were sceptical the ECB would even reach this stage. The Eurozone is still a relatively new concept, but it appears that Draghi remains determined to implement policies which avoid deflation. This requires further building of consensus and overcoming objections from more conservative members within the ECB over several years and a continuation of an approach ‘to do whatever it takes’ to save the Eurozone area. Until now, it can be argued that the ECB has come to the party ‘a Euro short and a day late’ almost seven years behind the Federal Reserve in starting their programme, and at the end of 2014 €1.3tn ($1.45tn) less assets on its balance sheet. With EU economies implementing an austere approach to fiscal policy there is now a strong argument that the ECB needs to be more targeted, creative and bolder in its program. The ECB has kept the door to further stimulus open, but perhaps should question whether expanding the current format of its program is suffering from diminishing returns and if there are other avenues to explore. There is an argument that activity from the ECB in the SME securitisation market could have the dual effect of increasing credit supply to the aforementioned companies where the need is most acute as well as helping to unclog European bank balance sheets.

Counter-arguments

Critiques of QE policies have commonly cited that banks are hoarding liquidity, stimulus has been favourable to larger corporates and holders of mortgage debt but impact on credit starved SMEs particularly in the periphery has been limited. Supply of assets within the current restrictions of the program will eventually pose a challenge. Furthermore, negative rates are damaging for the banking system, limiting the net interest income a bank can earn, necessary in order to rebuild the capital base to facilitate lending. Additional purchases of investment grade and government bonds is of limited value as spreads are already at extremely tight levels.

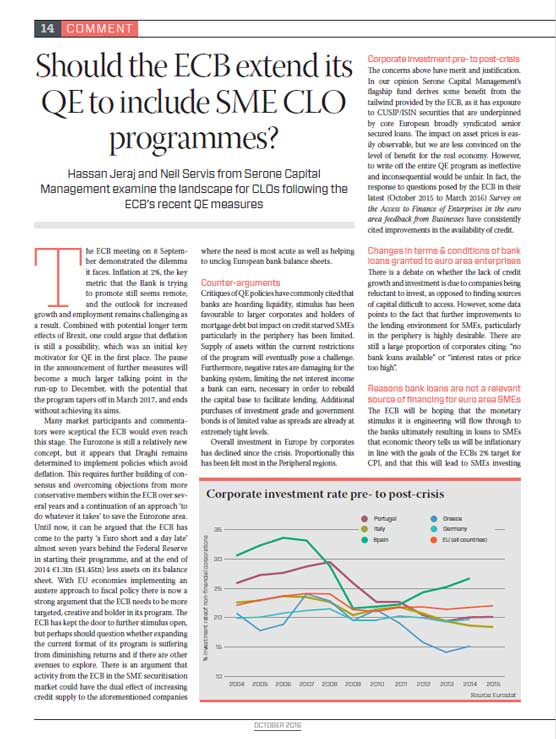

Overall investment in Europe by corporates has declined since the crisis. Proportionally this has been felt most in the Peripheral regions.

Corporate investment pre- to post-crisis

The concerns above have merit and justification. In our opinion Serone Capital Management’s flagship fund derives some benefit from the tailwind provided by the ECB, as it has exposure to CUSIP/ISIN securities that are underpinned by core European broadly syndicated senior secured loans. The impact on asset prices is easily observable, but we are less convinced on the level of benefit for the real economy. However, to write off the entire QE program as ineffective and inconsequential would be unfair. In fact, the response to questions posed by the ECB in their latest (October 2015 to March 2016) Survey on the Access to Finance of Enterprises in the euro area feedback from Businesses have consistently cited improvements in the availability of credit.

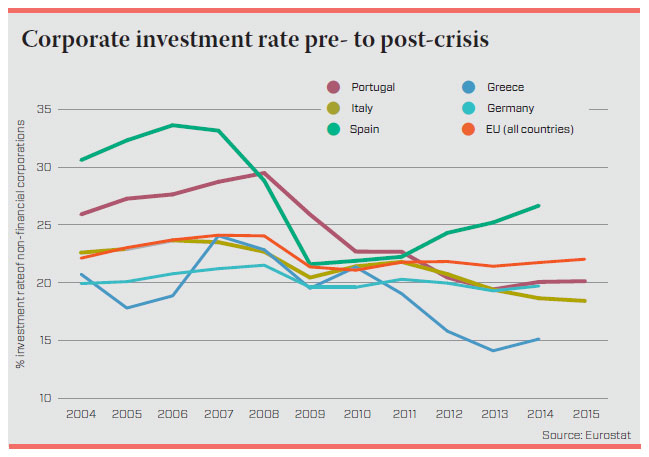

Changes in terms & conditions of bank loans granted to euro area enterprises

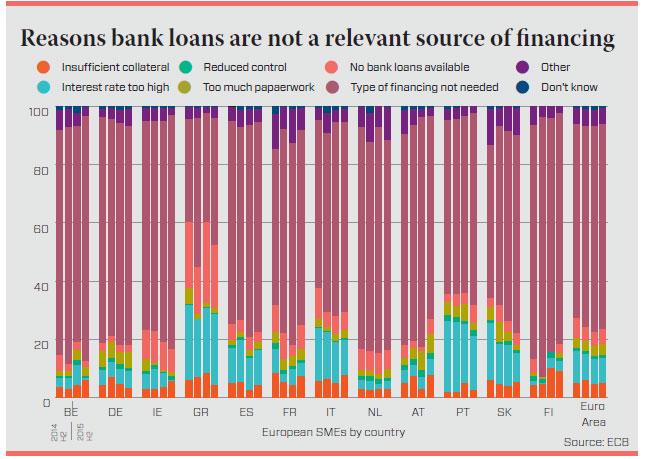

There is a debate on whether the lack of credit growth and investment is due to companies being reluctant to invest, as opposed to finding sources of capital difficult to access. However, some data points to the fact that further improvements to the lending environment for SMEs, particularly in the periphery is highly desirable. There are still a large proportion of corporates citing: “no bank loans available” or “interest rates or price too high”.

Reasons bank loans are not a relevant source of financing for euro area SMEs

The ECB will be hoping that the monetary stimulus it is engineering will flow through to the banks ultimately resulting in loans to SMEs that economic theory tells us will be inflationary in line with the goals of the ECBs 2% target for CPI, and that this will lead to SMEs investing which in time should increase demand, growth and employment. Th at said European banks are facing a number of headwinds; decreases in earnings power, legislated increases in capital requirements and reserves through CRD IV, sustained and heightened levels of non-performing loans on balance sheets. Th is has led to a situation where weaker banks, some of which are large and systematically important, are in a situation where they feel the need to raise capital (of high quality in line with new regulations e.g. perpetual AT1), which unsurprisingly is expensive or sell assets, often at a loss from the value that they hold them. These issues facing the banks are being mooted as the reasons why there has been a reduction in bank lending to SMEs, leading to European corporates investing less since the

crisis – put simply there are two opposing forces at work.

Disintermediation

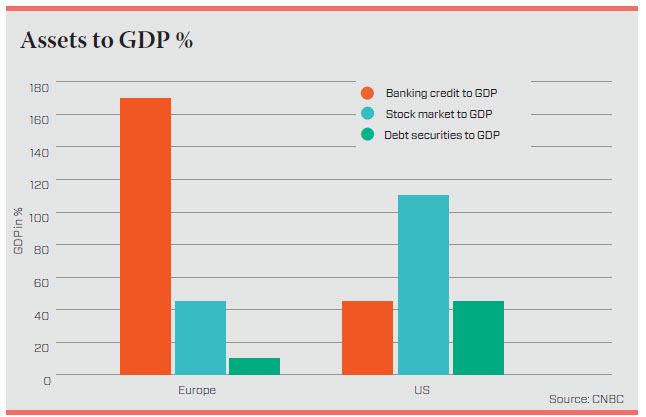

Since the crisis there has been increased interest in private debt and direct lending in the US and Europe. One could argue that in Europe this is more needed than the in the US, as lending in Europe historically has been driven by banks.

Assets to GDP %

Securitisation of SME corporate credit (and other asset classes) has fallen out of fashion since the credit crisis. However, there are a variety of reasons why this process makes sense including; transfer of funding and credit risk from banks balance sheets, promotion of lending into the real economy, creation of securities allowing investors to take exposure to diversified credit risk with varying risk and return profiles. Furthermore, if the ECB program promoted banks to securitise their existing loans this would help to clear credit channels by reducing the orange column and growing the green one instead.

Presently the ECB program allows the purchase of corporate bonds (unlike the US), which is a market dominated by large corporates. Smaller firms are more reliant on loans an area not directly aff ected by the stimulus. In order to impact the loan market, the stimulus must lead to both banks being in a position to lend, combined with increased disintermediation channels. This must come from the asset management and banking sectors as it would be impractical for the ECB to undertake loan underwriting, pricing and monitoring. Further more, the ECB is not set up to originate loans directly either.

Using securitisation techniques, similar to those found in the post crisis European CLO market, for existing and new SME debt, securities would be created with a range of ratings (from AAA to unrated), return and risk profiles. The ECB could participate in the senior tranche providing funding, alignment and a stamp of validation.

The underlying loans could come from existing bank balance sheets thereby unlocking bank capital clearing credit channels, or from new loans that would be originated by a correctly incentivised credit asset manager.

Other parts of the securitisation could be purchased by specialist, independent credit investors such as Serone Capital Management. Risk retention methodology implemented within the CLO market could be broadly followed to promote alignment of interests.

Interestingly the European Investment Bank, European Investment Fund and European Bank of Reconstruction and Development all recently participated in a Greek SME CLO called Sinepia with a 50.01% credit enhancement for its senior tranche that yielded E+185bps. If the ECB was to target senior SME tranches its validation of this market should attract further interest and capital. ECB interest at the senior part of the capital structure would help to entice investors into other parts of the capital structure. Th is would be particularly helpful in the periphery where Rating Agencies typically apply ratings caps due to sovereign ratings. As we all have been reading Italian banks could do with a helping hand – might securitisation be the way for the banks to deleverage, keep lending to a part of the economy that is such an important contributor to GDP?

Published

10 October 2016