The Serone Key Opportunities Fund wins Performance of the Year: Credit – Relative Value at the Hedgeweek European Awards 2025

The Serone Key Opportunities Fund wins Performance of the Year: Credit – Relative Value at the Hedgeweek European Awards 2025

The Serone Key Opportunities Fund wins again at HFM European Performance Awards.

Serone Capital Management launches the firm’s first European CLO, Monument CLO 1.

SKOF was nominated for the 2023 EuroHedge Awards under the Credit – over $500m category.

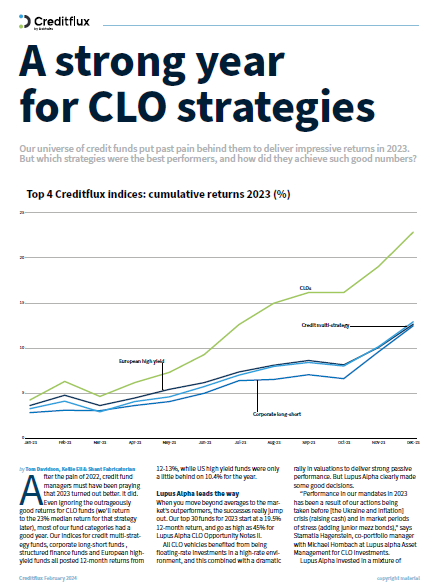

Our universe of credit funds put past pain behind them to deliver impressive returns in 2023.

18 April 2024

The Serone European Special Situations Master Fund picks up its first award for 2022.

The Serone European Special Situations fund takes the double at the Alt Credit Performance and Services Awards 2021.

Serone Capital’s European Special Situations Master fund made more than 30% in its maiden year, writes HFM’s Ludovica Brignola.

Ralph Herrgott, Portfolio Manager of the Serone Special Situations strategy has been highlighted and interviewed for the Hedge Fund Journal’s, ‘Tomorrow’s Titans 2021’.

Neil Servis, Chief Executive Officer and Founder at Serone Capital Management, discusses the search for yield.

Neil Servis, CEO of Serone Capital Management LLP spoke on a panel hosted by Eurex on the topic of finding and generating Alpha. Moderated by Matthias Knab of Opalesque, Neil was joined by two European allocators; Tilo Wendorff of Prime Capital AG and Marcus Storr of Feri Family Trust GmbH.

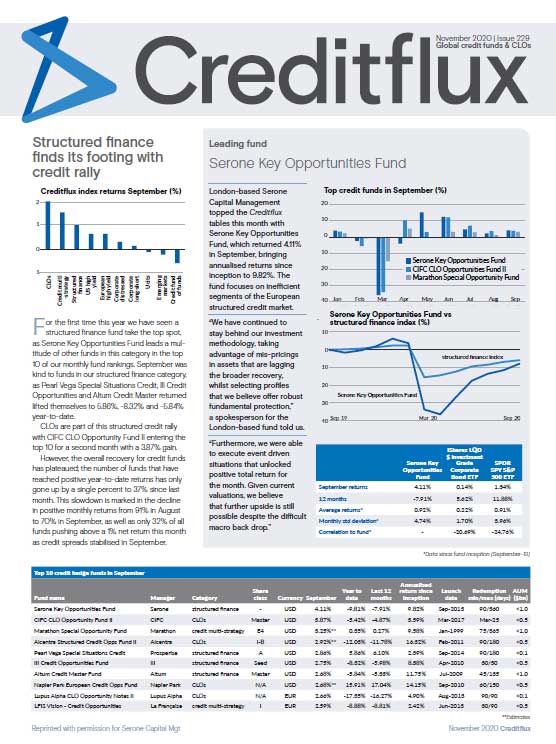

Serone Capital Management topped the Creditflux tables this month with Serone Key Opportunities Fund.

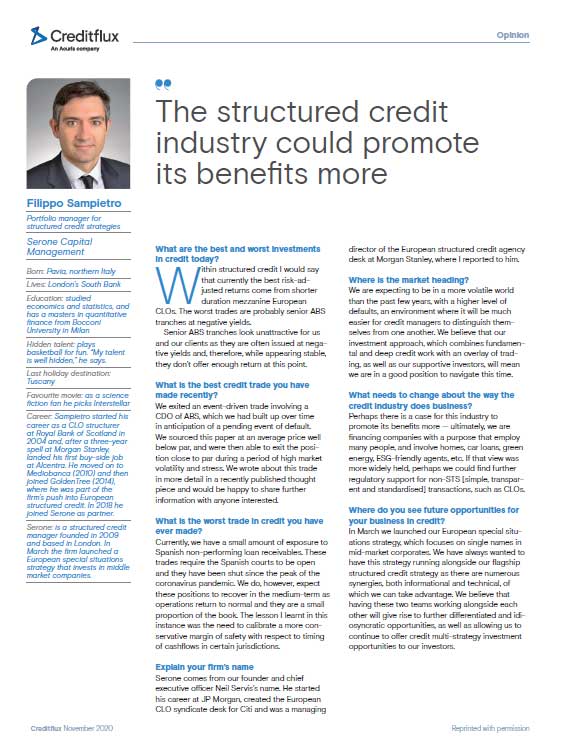

Filippo Sampietro, Portfolio Manager within Serone’s Structured Credit team recently had the pleasure of being interviewed by Creditflux.

Serone’s Key Opportunities Fund is recognised for its longer term performance once again (5 years) by winning in this category.

The Serone Key Opportunities Fund secures the top spot.

Filippo Sampietro, Portfolio Manager at Serone Capital Management, discusses investment strategy.

Stuart Chapman, Director of the Investment Team at Serone Capital Management, speaks about investing in structured credit.

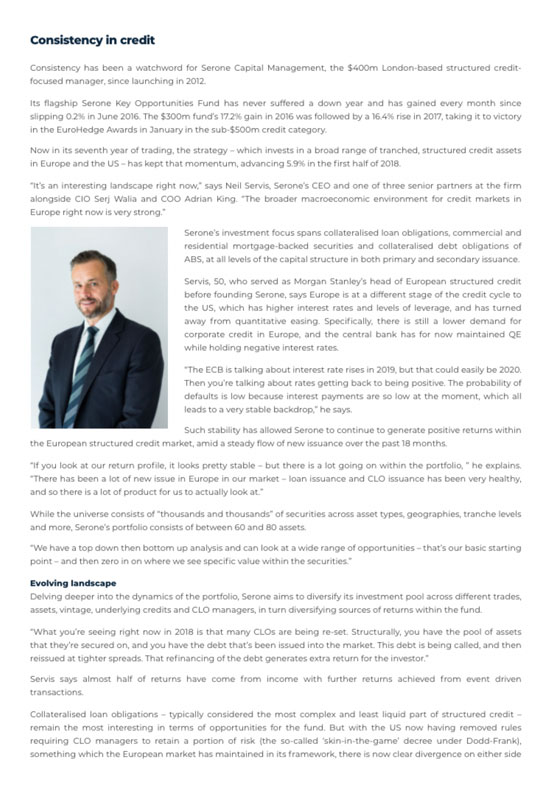

Consistency has been a watchword for Serone Capital Management, the $400m London-based structured credit-focused manager, since launching in 2012.

CLOs are a crucial consideration for investors seeking diversified, uncorrelated returns. Neil Servis, CEO of Serone Capital Management, offers his insights.

The Serone Key Opportunities Fund edges out the competition.

Stuart Chapman, Director of Investment Research and Analytics at Serone, compares the U.S. and European investment environments.

The Serone Key Opportunities Fund picks up an award.

The Serone Key Opportunities Fund wins for the first time at EuroHedge.

Serone Key Opportunities Fund scores a double victory.

Serone Key Opportunities Fund scores a double victory.

The Serone Key Opportunities Fund takes the Long Term Performance award.

The Serone Key Opportunities Fund wins in a broad Asset-Backed category.

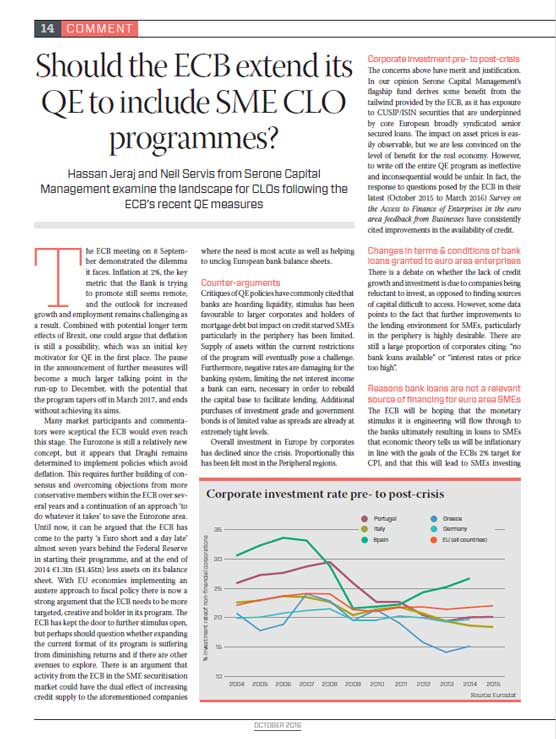

“One could argue that defation is still a possibility”.

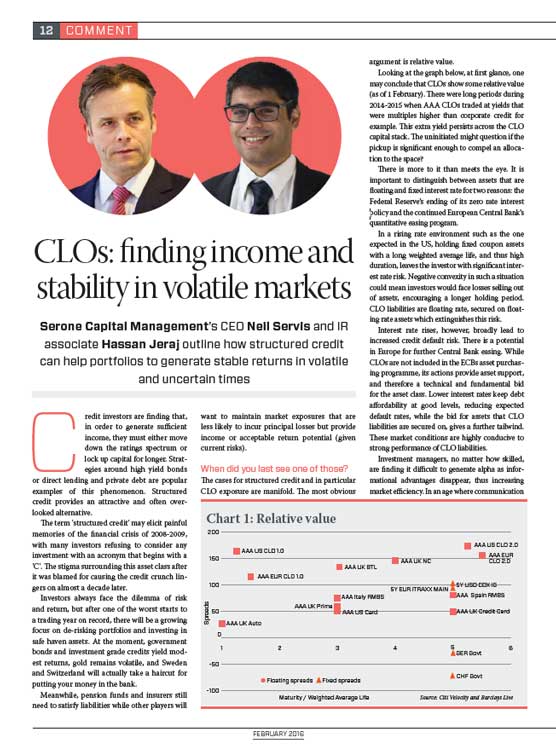

Hassan Jeraj and Neil Servis from Serone Capital Management examine the landscape for CLOs following the ECB’s recent QE measures.

The Serone Key Opportunities Fund continues its winning momentum.

Serone Capital Management’s CEO Neil Servis and IR Associate Hassan Jeraj outline how structured credit can help portfolios to generate stable returns in volatile and uncertain times.

The Serone Key Opportunities Fund ranks # 1 in the Fixed Income – Long/Short Credit category.

The Serone Key Opportunities Fund beats the competition in the CLO Specialist category.

James Williams interviews structured credit specialists Serone Capital.

A forensic investment approach and a market ripe with opportunities have left Serone Capital in an ideal position to exploit the growth in European securitisation. Claire Coe Smith sat down with the firm’s CEO, Neil Servis, and other senior team members.

In his last column, our Secret CEO pulled no punches in his criticism of hedge funds. Here, hedge fund insider James Williams hits back, insisting the vehicles have never been more important.

The Serone Key Opportunities wins three years running.

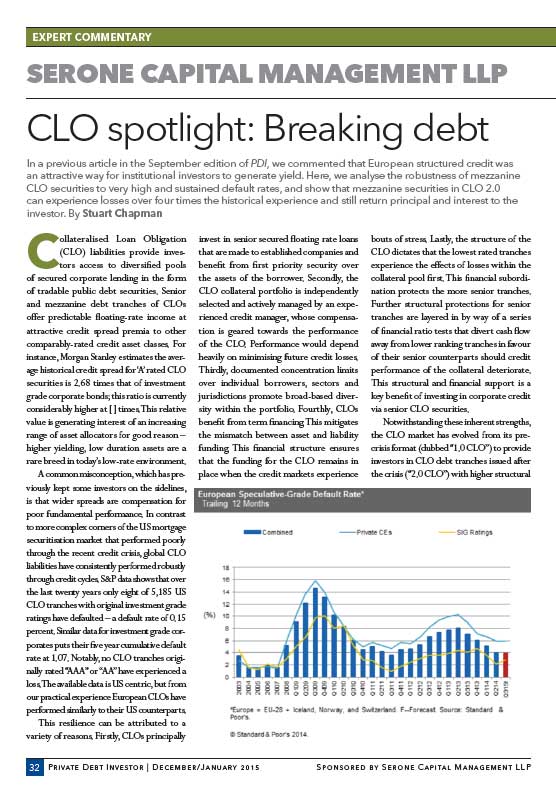

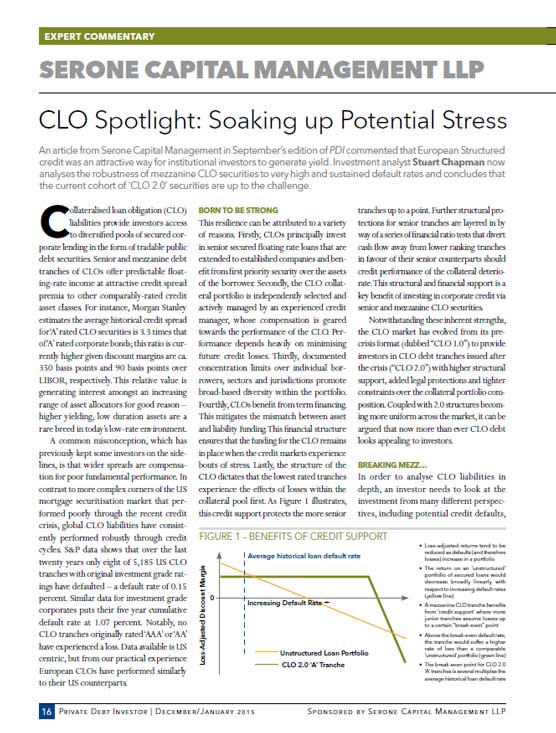

In a previous article in the September edition of PDI, we commented that European structured credit was an attractive way for institutional investors to generate yield.

An article from Serone Capital Management in September’s edition of PDI commented that European Structured credit was an attractive way for institutional investors to generate yield.

The Serone Key Opportunities fund has delivered impressive returns over its first 30 months.

European structured credit is an increasingly attractive option for US institutional investors seeking yield, argues Serone Capital Management’s Neil Servis.

The Serone Key Opportunties wins its second award.

Serone wins it’s first award.